Tremec-trification

Automotive Engineering / January 3, 2024 / Bill Visnic

Tremec is charting a future in vehicle electrification that leverages the company’s gear-manufacturing history while clearly departing from its intrinsic connection to internal combustion engine. Tremec, a transmission developer and manufacturer, was created in 1964 to build transmissions in Mexico for Ford, GM and then-Chrysler. Like many longstanding auto-sector suppliers, Tremec is now remaking itself to be successful in the inevitable EV transition, and the company is shaping that transformation with a strategy that reflects its unique market presence.

Industry insiders and performance enthusiasts know Tremec by its decades-long reputation in manual-transmission development and, most recently, as the supplier of the brilliant automated manual transmissions that flavor the high-performance character of the current eighth-generation Chevrolet Corvette and the thundering Ford Mustang Shelby GT500, among other high-profile applications. The company produces about 300,000 light-vehicle transmissions and upwards of 80,000 commercial-vehicles transmissions a year, said Matt Memmer, Tremec’s director, engineering and program management, in an interview with SAE Media in the first half of 2023. Memmer emphasized how Tremec’s internal combustion-related transmission expertise is fueling its expansion into electric propulsion.

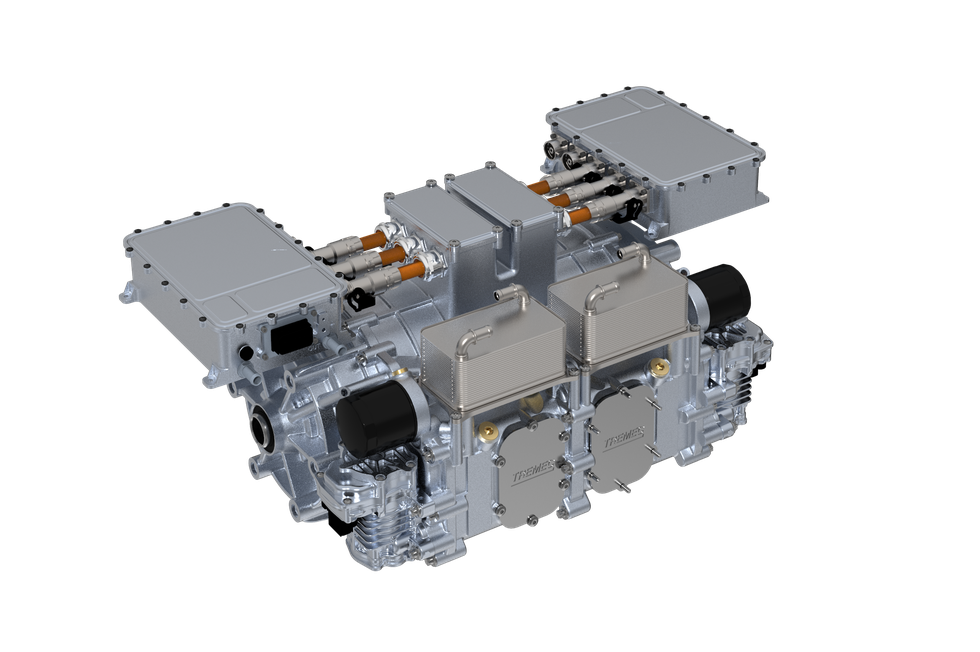

The company’s palette of next-generation products includes a family of electric drive units (EDUs) that feature traction motors in single and dual configurations that operate on a single drive axle. The drive units integrate the traction motors with silicon-carbide (SiC) power electronics and the company’s own gearsets.

Memmer said the initial market focus is on comparatively low-volume performance applications that could provide an easy path for an OEM to add a high-performance variant to a more workaday EV. Tremec’s engineers have ensured that capability isn’t an issue. Tremec displayed a dual-motor EDU featuring internal permanent-magnet (IPM) design in a 736-kW (986-hp) specification at the 2023 Specialty Equipment Market Assn. (SEMA) show. The 800-volt capability and SiC electronics help optimize efficiency, which in turn enhances driving range, while oil cooling enables consistent delivery of maximum power even under demanding racetrack conditions, Tremec said.

The DC 7010 dual-motor EDU weighs just 243 lb. (110 kg) and is 90% efficient on the WLTP test cycle. It produces what the company claims is a class-leading 5.25 kW per kilogram – while peak torque can be as much as 4000 Nm (2950 lb-ft) at each wheel. Maximum motor speed is 16,000 rpm and can generate vehicle speed of up to 186 mph (300 km/h) with its single-ratio epicyclic gearset. Memmer said although using single- or multi-speed transmissions can be “very application-dependent and motor-dependent,” single-speed transmissions are adequate for most EVs using high-rpm motors. “Single-speed for performance vehicles is fine. For lower-speed motors, a two-speed makes sense; commercial vehicles, multi-speed almost certainly makes sense. Offroad – where you want a real deep gear, for example – multi-speed probably makes sense there.”

Specialty focus

Memmer stressed that Tremec doesn’t intend to compete with OEMs or Tier 1 suppliers’ own traction-motor development and manufacturing. The company sees its EDUs and other electric-drive components as options for OEMs to augment their volume traction-motor offerings. There are also interesting aftermarket possibilities.

“Our goal is to not compete with the vertical integration of the OEMs or with the high-volume [suppliers],” Memmer asserted. “It’s to participate in the more specialty segments and offer a solution that has a high level of performance in a very dense package space. One of the objectives at the OE level is to be able to offer them a solution that is a higher performance level than their vertically-integrated standard products.”

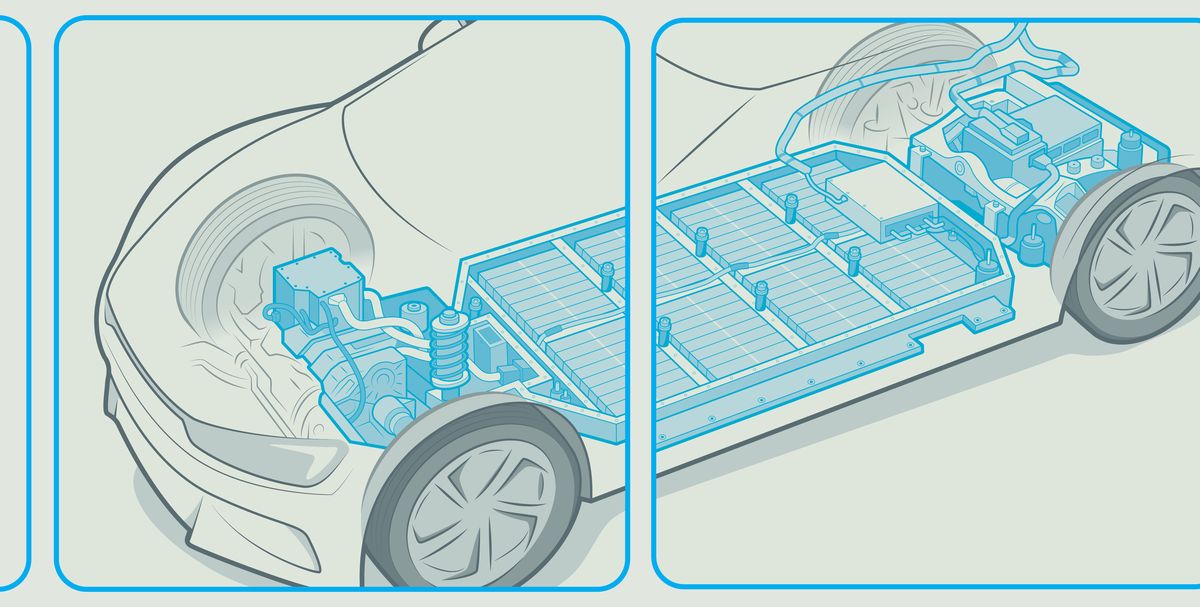

Crucially, though, Tremec engineers concentrated on keeping its EDUs’ footprint and weight to a minimum. Memmer said its aim is to offer exceptional motor power density that packages in the same space as a “production” EV drivetrain. “They don’t have to redesign the vehicle architecture, they don’t have to come up with a new frame. They don’t have to do much other than put ours in,” Memmer explained. “Now there’s more to it than now you got to make the battery and everything else. But we would like that space – that’s kind of our core space as it is.”

But there’s more. “There’s an aftermarket space that’s growing very quickly with battery electric conversions,” he added. “And that’s a space we’re already very heavily entrenched in, in the aftermarket side with our [existing] manual transmissions. We see a lot of opportunity to bring the same product from an OEM level into the aftermarket just like we’ve done on the transmission side.”

Apart from its EDUs for EVs, Tremec also developed a single-motor “drop-in” EDU for conversions. The unit incorporates a permanent-magnet traction motor, SiC inverter and helical gearset that are cleverly packaged as an “eCrate” system to fit in an existing IC vehicle’s transmission tunnel.

To boost the profile of its EDUs’ aftermarket potential, Tremec acquired Electric GT, a developer of plug-and-play ICE-to-EV conversions in August 2023. In a media release about the acquisition, Tremec said it can now, “[provide] the customer with all the components necessary for the conversion, including batteries, cabling, drive motors, inverters, gearboxes and the control systems necessary to install and operate the system safely and effectively.”

Memmer said the company’s aftermarket strategy offers a high-value system perspective that has significant potential. “If you’re doing a classic car, if you’re a builder who specializes in classic cars, you don’t necessarily know how to go out and piece all these [EV conversion components] together. But if we give you a whole system – here’s the batteries, here’s the cabling, here’s the drive unit, here’s everything you need – and you do what you do well, which is fabricate and fit it into the vehicle, we’ll give you all the rest. That’s where I think where the market goes.”

He concedes that at least at the moment, the relative newness and complexity of EV conversions present challenges. “But I think that’s also where the ‘system’ approach helps, because you design battery packs and you design cabling and you design everything for certain chassis and you can provide some recommendations on how to get the weight balance where [the fabricator] needs it and how much power level to really put in there. Because yeah, dropping in our dual-motor EDU, that’s 800-plus horsepower – if you don’t balance the other things, it could be an interesting result, right? So, I think that’s where there’s definitely help and guidance that’s needed. And that’s one of the things that when you talk to the aftermarket builders, they’ve got concerns about handling high voltage and how do I do that safely for my mechanics?”

Whether for OEM fitment or the aftermarket, the company’s volume targets for its EDUs are in line with its current performance-market presence. “Our targets right now are low-volume production in 2026, volume production in 2028,” Memmer said. “And I think there’s plenty of opportunities that align those. ‘Low-volume’ for us would be in the hundreds – 500 a year to a couple thousand, 2,500 a year. ‘High volume’ or ‘volume’ for us would be any individual program over 10,000 a year. Somewhere in that 10,000 to 50,000 range. When we say ‘high-volume,’ we’re talking about tens of thousands, but not hundreds of thousands. Not that we would turn that down,” he laughs.

Value-adding with technology

A key feature of Tremec’s dual-motor EDU is built-in torque-vectoring capability. Memmer said the feature is particularly valuable for the high-performance applications it’s targeting. “Because you have independent control of two motors, that goes well beyond what you have in a traditional ICE configuration. He said ICE vehicles can achieve torque vectoring through a differential, but that kind of torque control isn’t as precise as you can get with electric motors.

“Because you have very good control of the motor, you also know exactly what the motor is doing,” he said. “It’s connected directly to the wheel. If you have wheel slip, you know your differential speed and you can respond very quickly. You can provide very high levels of power control and you can shape that to the modes that you want for the vehicle. Do you want high-performance track cornering? Do you want a little bit of oversteer or understeer? Do you want a ‘drift’ car? All of those things are possible because you have that independent control that you don’t have in an ICE engine.”

Such is the same with motors themselves. Memmer said Tremec has developed both IPM and surface permanent-magnet (SPM) motors, settling on PM as “the only real option for us in terms of performance level that we need and package space.” He said IPM and SPM designs have tradeoffs in power density, packaging size and cost.

“On the IPM side, you have to get a little bit bigger, although they’re starting to become pretty close. And they have some advantages in cost. There’s a lot of technology going into how you wind the copper, to try to increase the density there. As we work with suppliers on both sides, we see there isn’t a one-motor solution that works for everybody. One of the things we’ve tried to do is understand the options and then pick the right motor for the application. There’s always cost and packaging and performance and thermals [considerations]. All of those things are trade-offs.

“So rather than just saying we’re only going to do this kind of motor and that’s the only thing we’re going to offer,” Memmer continued, “we’re going to try to keep that relatively open to pick the right motor for the application. And that’s something else we try to offer to the customers – we’ll work with them to understand their requirements.”

Tremec also takes seriously its in-house software and mechatronic-controls competency – be it for ICE-supporting dual-clutch automated-manual transmissions or EDUs. “Most of our software development is in Belgium,” he said. “We have calibration engineering here locally in the U.S. and we have a little bit of software in Mexico, but limited. But almost all of it is in Belgium. That’s where we do all the DCT software where we’re doing all the EDU development.”